Under its Main Street Lending Program launched on Monday, the Federal Reserve plans to provide aid to eligible nonprofit organizations devastated by the coronavirus pandemic. The Fed is currently collecting public comments on the expansion of the program to finalize the term sheets for nonprofits.

For families in need and people requiring financial assistance due to rampant job cuts, nonprofit organizations are a beacon of hope for survival. Charities such as Feeding America, Half-Table Man Disaster Relief, and many others have contributed to the on-going response to provide support to people in need in this challenging time.

While the world looks closely at the impact of COVID-19 on the economy, or their lives, in general, nonprofit organizations are on the frontlines, serving tirelessly to aid those who are affected by the coronavirus.

However, nonprofit organizations are facing significant challenges in the eyes of the pandemic. In a survey conducted by Charity Navigator, in partnership with Reuters News, 83% of respondents out of 4,598 nonprofit representatives reported financial hardship, with an expected decline of 38% between April to June.

The survey also adds that due to stay-at-home-orders limiting large-scale gathering, program cuts jumped to 64%, with 48.8% reported shutting down a primary program completely.

This puts nonprofit organizations in danger of losing funding to pursue their mission and continue making payroll. Most nonprofits and charities source their funding from fundraisers, individual donors, grants, or private/corporate philanthropies.

Last April 14, 2020, 300 local nonprofits reported losing $32 million of funding in the early weeks of the pandemic. Momentum Nonprofit Partners’ Executive Director Kevin Dean, the source of the survey, said that “… a lot of nonprofits [will be] struggling in 2020.”

He adds: “In the nonprofit world, we rely on special events to earn income and also bring in new donors, and we had to cancel all of those events.”

In a report published by Forbes, charities such as the United Way Worldwide 211, The Jewish Federations of North America, Goodwill Industries International, YMCA, among others appeal to Congress to include a $60 billion emergency fund for charities, nonitemizer deduction, and Small Business Administration loan for charities in the $2 trillion economic relief.

“… we need help on a scale that only the federal government can provide so we can continue supporting these communities now and when this crisis is over,” said Kevin Washington, president and CEO of YMCA.

Federal Reserve Assistance to Nonprofit

On Monday, June 15, 2020, the Federal Reserve opens public feedback on the expansion of its Main Street Lending Program in providing loans to “eligible” small and medium-sized nonprofit organizations “that could benefit from additional liquidity,” the press release added.

Federal Reserve Chair Jerome H. Powell recognizes the importance of nonprofits amidst the COVID-19 pandemic. In his statement, Powell emphasizes that the Fed prioritizes nonprofit organizations due to the essential services they provide in today’s global health crisis.

“… we are working to help them through this difficult time,” Powell said.

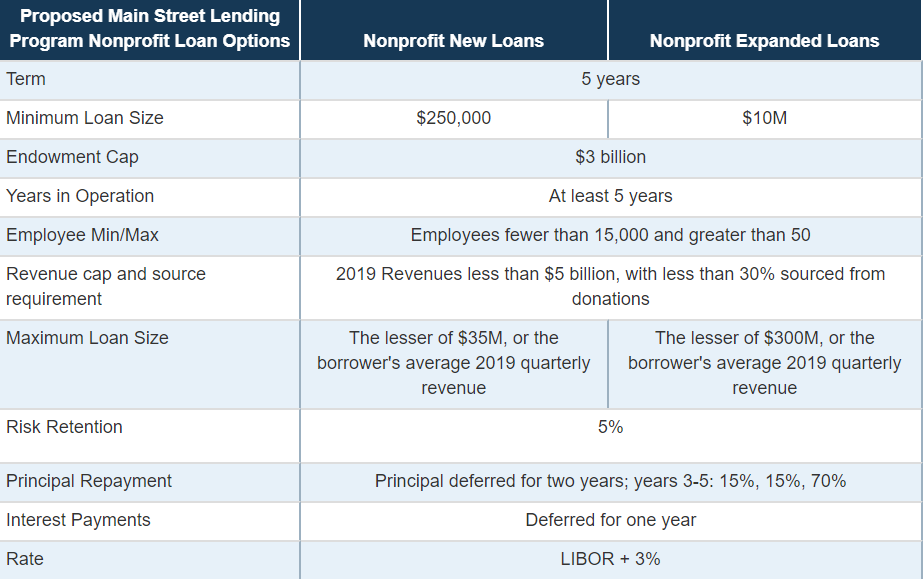

In the proposed Main Street Program for nonprofit organizations, the Fed offers a minimum loan size of $250,000 to a maximum of $300 million. The loan terms are similar to business loans offered within the Main Street Program, including interest rates, deferral of principal and interest payments, and a five-year term. Principal payments are fully deferred for the first two years, and interest payments are delayed for one year.

Any 501(c)(3) or 501(c)(19) organizations with 50 and 15,000 employees with revenues less than $5 billion and had less than 30% of those revenues sourced from donations are eligible to apply.

Nonprofits organizations account for 5 to 10% of the U.S. economy, employing roughly 11.9 million people, making the industry the third-largest employer behind retail and manufacturing. In 2015, the industry contributed an estimate of $985.4 billion to the U.S. economy or 5.4% of the country’s GDP.

The Federal Reserve is currently asking for public comment on its proposals until June 22, 2020.