Dive Brief:

-

Stitch Fix continues to confront problems caused by its move to add traditional e-commerce to its sales approach. Second quarter net revenue rose 3% year over year to $517 million, as revenue per active client rose 18% to a record $549, per a company press release.

-

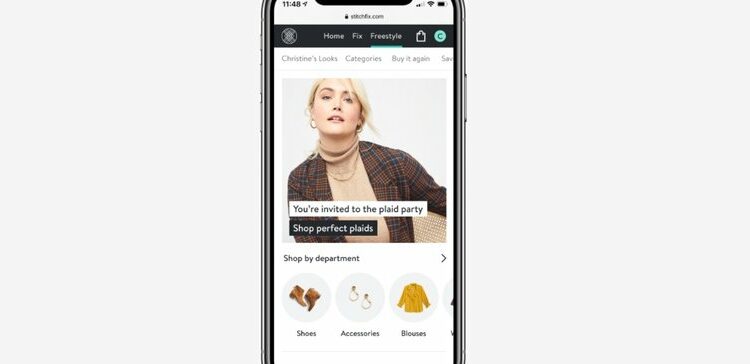

Freestyle sales rose 29%, but the company said it’s still struggling with onboarding and conversion of clients. The site has been revamped to provide “a clear and easy Fix onboarding path,” and a search feature will be added at an unspecified time.

-

Net loss in the period widened to $31 million from $21 million a year ago. Given the volatility, Stitch Fix lowered its revenue guidance for the year and pulled its guidance for adjusted EBITDA.

Dive Insight:

Even as it introduced traditional e-commerce sales to supplement its curated box operations and boost its growth prospects, Stitch Fix has tried to hold on to its differentiation.

New shoppers arriving at its website, for example, aren’t able to shop Freestyle until they sign up and take a quiz. Even then, the customer can’t search the Freestyle site, on the premise that the company’s algorithms, based on quiz results plus any sales, returns or other customer feedback, will pull up any items the customer would want.

That’s turning out to be an awkward approach, as predicted by some observers months ago, and the company is in the process of revamping its site to lessen the confusion.

“We have already made changes to enable a better logged-out experience, including the ability to add multiple items to a shopping bag and checkout while logged out,” CEO Elizabeth Spaulding told analysts during a Tuesday conference call. “We also understand that there are a number of basic but necessary features we need to add to Freestyle, such as search functionality, which we plan to introduce in the coming quarters.”

Executives said the company’s first sale, held in January, was small but successful and that future promotions would be similarly targeted. MKM Partners Managing Director Roxanne Meyer said in emailed comments that the company may need to resort to more discounting.

Freestyle is competing with apparel retailers that don’t run a box business and don’t require style quizzes, and it remains to be seen whether those differences are advantages or disadvantages.

“[W]e maintain concerns around the long-term viability of the Freestyle business given the friction points inherent in the onboarding strategy versus a relatively frictionless competitive landscape,” William Blair analysts Dylan Carden and Phillip Blee said in emailed comments. “We view Freestyle as more of a strategic asset in gaining greater wallet share with existing Fix customers, though the recent sales guidance suggests the growth and profitability of the core U.S. business appears to be stagnating, if not declining.”

Spaulding pushed back when asked whether it might be wise to allow the subscription Fix business to dwindle over time, given Freestyle’s more favorable prospects and economics. “The ecosystem together is where we see tremendous value,” she said. “Our best clients are participating in both in a very value-added way.”